Electronic Warehouse Receipts' (eWHR's)™

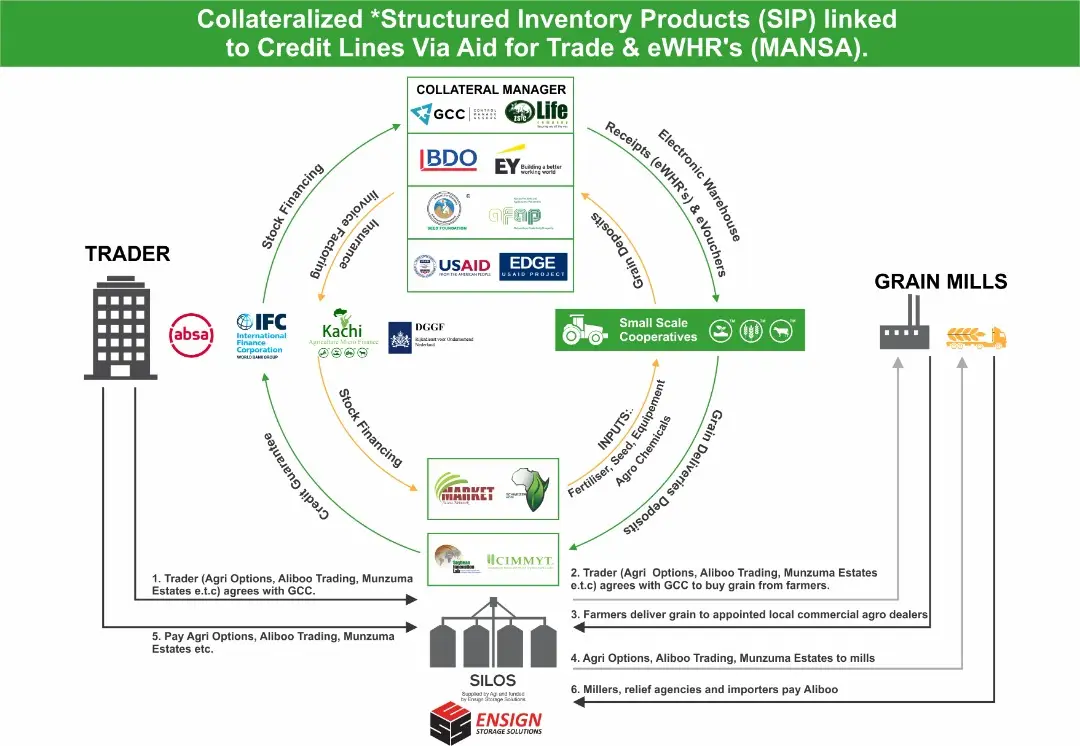

The proposed Structured Inventory Products (SIP), an agriculture stimulus package through Electronic Warehouse Receipts’ (eWHR’s)™ under a registered collateral manager.

The Electronic Warehouse Receipts’ (eWHR’s)™ can provide a solution to the lack of assets, which limits small and rural farmers from accessing traditional capital. Electronic Warehouse Receipts’ (eWHR’s)™ allow farmers to store goods in return for a receipt. This means that they can sell their produce at a later time, when prices are most favorable. In addition to providing a secure place to store produce, farmers can also collateralize their warehoused commodities to cover credit from financial institutions. As an innovative credit tool, Electronic Warehouse Receipts’ (eWHR’s)™, among other benefits, reduce the pressure on the farmer to sell the commodity immediately after harvest, when prices are normally low and reduce post-harvest losses.

However, these Electronic Warehouse Receipts’ (eWHR’s)™ have not yet been widely adopted in Zambia and the region. There are two main challenges. The first is securing the resources to manage the system.

The second is convincing farmers to choose storing their produce until it reaches a better price, over selling immediately after harvest.

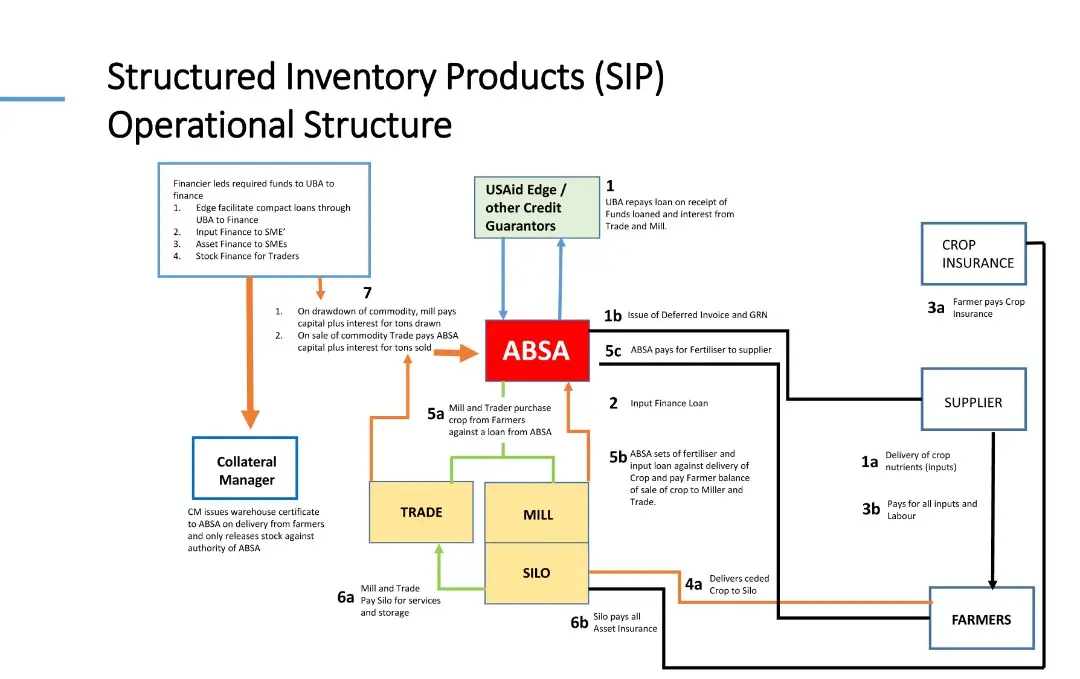

Regulations enabling bankers and insurers to accept stored produce as collateral will also need to be introduced to facilitate the following activities to include:

- Inputs can be placed on farm on extended credit terms sufficient to plant and harvest the crop and get paid.

- Payment for the inputs will be by way of deduction from the sale of the crop (soya, maize, wheat, dolichos lab lab, pineapples, cowpeas, sunnhemp, Irish potatoes or livestock )

- Interest will be charged at an agreed percentage month after 30 days – as per normal terms and conditions;

- Schweizer Agriculture through USAID EDGE Zambia Activity has participated, lead and mobilized a stake holders group of commercial banks, development aid organization, relief agencies and private entities such as Absa, United Bank for Africa Zambia (UBA) Ltd, Global Collateral Control (GCC), Stanbic Bank, Zambia Industrial Commercial Bank (ZICB), Zambia Agriculture Research Institute (ZARI), Seed Control & Certification Institute (SCCI), Western Seed, Aliboo Trading, Yara Fertilizer Zambia Ltd, Agri Options Ltd, NewGrowCo etc.

i. These private and public institutions will participate to assist small scale farmers inclusion in the SIP linked to eWHR’s that has three offers for the grower.

ii. The first to local cooperative members and second to none members to consider for example.

- A $385/mt minimum offer with a 90/10 split on any upside i.e. if the market went to $420/mt the grower would receive 90% of the $35 upside and be paid $416.50. The market price would be determined by the weighted average of Grain Traders Association of Zambia (GTAZ), Novatek, Mount Meru or Global and at time of delivery at a registered local agro dealer’ warehouse or silo complex controlled and managed by Global Collateral Control (GCC).

- Alternatively offer a $500/mt flat price to the farmer which would be locked in through an Electronic Warehouse Receipts’ (eWHR’s)™.

- Thirdly the grower would be given a minimum offer with a 5/95 split on the value add price if the soya would be value added into TSP to be added to his warehouse receipt coupon that is redeemable only for procurement of future fertilizers, seed, chemicals or implements at maturity.

For more information download the attached brochure: